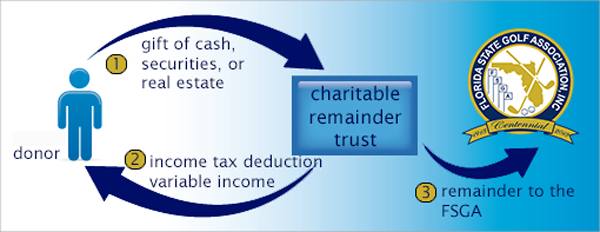

A charitable remainder trust names one or more beneficiaries for life or for a term of years, after which time the assets go to the FSGA.

How it Works

- Donor transfers cash or securities into trust

- The trust pays a percentage of its income to you or your beneficiaries

- When the trust ends, the remainder goes to the FSGA

Donor Receives

- Donor or Beneficiaries receive income

- Asset segmentation and preservation

- May be created for a specific term of years or the life of the donor

- Funds to be manged by the donor's investment management company

- You may make additional contributions to the trust in future years

Tax Savings

- Receive an immediate income tax deduction for a portion of your contribution

- Value of trust assets at death generally deductible from estate for tax purposes

- Capital gains tax bypassed at time of funding

The FSGA Receives

- The FSGA receives a substantial gift when the trust terminates.

- Knowledge of the gift helps the FSGA in planning to meet future needs.