Charitable Lead Trusts are especially attractive during times when interests rates are low and when assets used to fund them are expected to grow over time.

How it Works

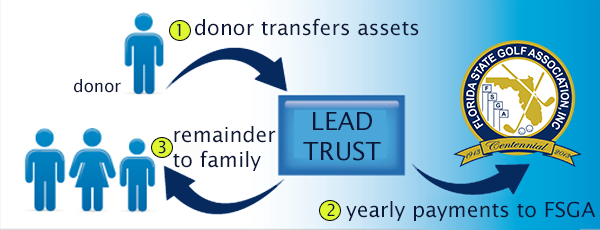

- You contribute assets or securities to a charitable lead trust.

- The trust makes fixed annual payments to the FSGA for a specified period of time.

- When the trust ends, the remaining principal is paid to you or your heirs.

Benefits of a Charitable Lead Trust

- The amount of the charitable gifts can be fixed or vary over time.

- Income payments to the FSGA reduce the ultimate tax cost of transferring an asset to your heirs.

- This gift can reduce or eliminate income, estate, and gift taxes now and in the the future.

- All appreciation that takes place in the trust goes tax-free to the individuals named in your trust.

- You may be able to provide younger heirs with a larger inheritance at a more appropriate time in their life.